In today’s fast-paced business environment, professionals with strong accounting and finance skills are in high demand. Accounting and Finance Training programs provide learners with the technical expertise, analytical tools, and strategic insights needed to manage finances effectively, make informed decisions, and grow in their careers.

Whether you are a beginner seeking foundational knowledge or an experienced professional aiming to advance, this training covers everything from financial statements and bookkeeping to budgeting, analysis, and corporate finance.

What Is Accounting and Finance Training?

Accounting and Finance Training is a structured learning program that equips participants to:

- Understand and interpret financial statements

- Perform bookkeeping and accounting tasks

- Manage budgeting, forecasting, and cash flow

- Conduct financial analysis and reporting

- Learn corporate finance principles

- Apply decision-making and strategic planning

- Use Excel and finance tools for professional tasks

The program combines theory with practical exercises, allowing learners to apply knowledge to real-world financial scenarios and business decisions.

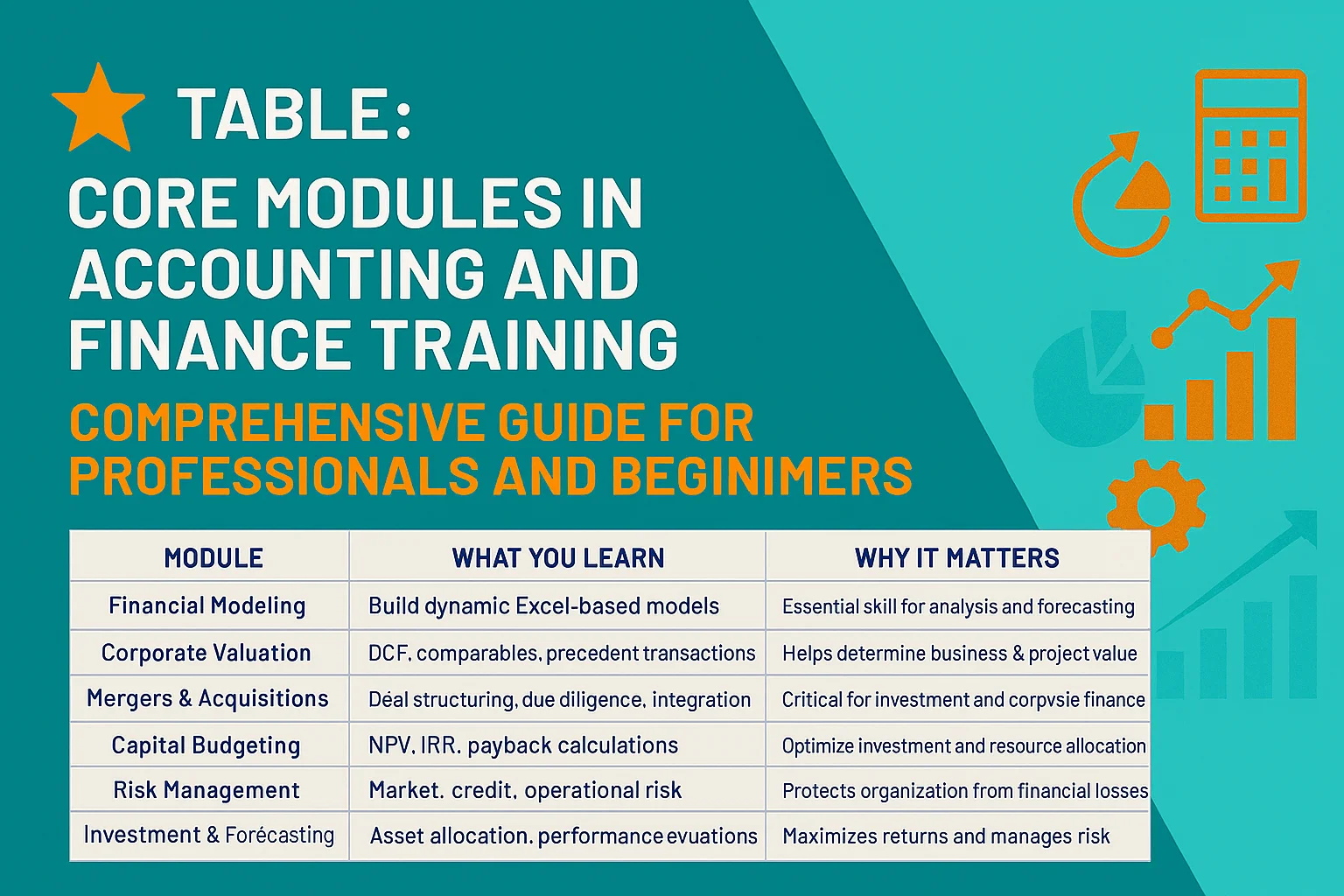

⭐ Table: Core Modules in Accounting and Finance Training

| Module | What You Learn | Why It Matters |

|---|---|---|

| Financial Accounting | Balance sheet, income statement, cash flow | Fundamental accounting knowledge |

| Bookkeeping | Recording transactions, ledger maintenance | Ensures accurate financial data |

| Budgeting & Forecasting | Annual budgets, rolling forecasts | Guides financial planning and strategy |

| Financial Analysis | Ratio analysis, performance metrics | Helps assess business health |

| Corporate Finance | Capital structure, investment decisions | Supports strategic decision-making |

| Taxation & Compliance | Tax rules, regulations, reporting | Ensures legal compliance |

| Excel for Finance | Formulas, pivot tables, modeling | Critical technical skill for finance roles |

| Cost Accounting | Cost control, budgeting, variance | Optimizes operational efficiency |

| Strategic Finance | KPIs, scenario analysis, dashboards | Informs executive decisions |

Why Accounting and Finance Training Is Important

- Career Growth: Professionals gain skills to advance to senior roles such as Finance Manager, Accountant, Financial Analyst, or Controller.

- Practical Knowledge: Learners can handle real-world financial tasks confidently.

- Decision Support: Training equips participants to provide data-driven insights for business strategy.

- Compliance & Accuracy: Professionals understand regulatory requirements and ensure accurate reporting.

- Analytical Expertise: Enables evaluation of financial performance and identification of improvement areas.

Who Should Enroll?

Accounting and Finance Training is ideal for:

- Finance and accounting students

- Fresh graduates seeking professional skills

- Working accountants or finance staff

- Entrepreneurs and business owners

- Corporate finance analysts

- Anyone looking to improve financial literacy

Whether you’re starting a career or enhancing existing skills, this training provides a structured pathway to financial mastery.

Key Skills You Will Learn

1. Financial Accounting

- Prepare and analyze financial statements

- Understand accounting principles (GAAP/IFRS)

- Interpret profit & loss, balance sheet, cash flows

2. Bookkeeping

- Record daily transactions accurately

- Maintain ledgers and journals

- Reconcile accounts

3. Budgeting & Forecasting

- Plan annual and quarterly budgets

- Track expenses and revenue

- Forecast future financial performance

4. Financial Analysis

- Ratio analysis (liquidity, profitability, solvency)

- Performance benchmarking

- Identifying trends and areas for improvement

5. Corporate Finance

- Investment decision-making

- Capital structure optimization

- Risk and return evaluation

6. Taxation & Compliance

- Learn corporate and individual taxation

- Regulatory compliance

- Filing and reporting requirements

7. Excel & Finance Tools

- Pivot tables, formulas, macros

- Financial modeling

- Data visualization and dashboards

Career Opportunities After Training

Completing Accounting and Finance Training opens doors to roles such as:

- Financial Analyst

- Accountant / Senior Accountant

- FP&A Analyst

- Corporate Finance Associate

- Tax Analyst

- Budget Analyst

- Finance Manager / Controller

- Strategy & Operations Analyst

These roles offer strong career growth and global opportunities across industries.

Benefits of Accounting and Finance Training

- Gain practical, hands-on financial skills

- Improve decision-making and strategic insight

- Enhance employability and career prospects

- Strengthen knowledge of compliance and regulations

- Build confidence in financial reporting and analysis

- Master Excel and other financial tools for professional use

Conclusion

Accounting and Finance Training equips professionals and beginners with essential skills for modern financial roles. By covering financial statements, bookkeeping, budgeting, corporate finance, analysis, and strategic planning, this training ensures learners are job-ready and capable of supporting organizational growth.

Whether you are a student, professional, or entrepreneur, this training provides the expertise needed to analyze, plan, and optimize financial performance, making it a valuable investment for long-term career success.