The cryptocurrency market has become one of the most volatile financial markets in the world. Sudden crashes, where prices drop sharply in a short time, often create panic among investors and attract widespread media attention. Understanding Why Is the Crypto Market Crashing is crucial for traders, investors, and crypto enthusiasts to manage risk, make informed decisions, and identify opportunities during downturns.

While crypto is inherently volatile, market crashes are usually triggered by a combination of regulatory actions, macroeconomic conditions, market speculation, leverage, exchange failures, and investor sentiment. Let’s break down these factors in detail.

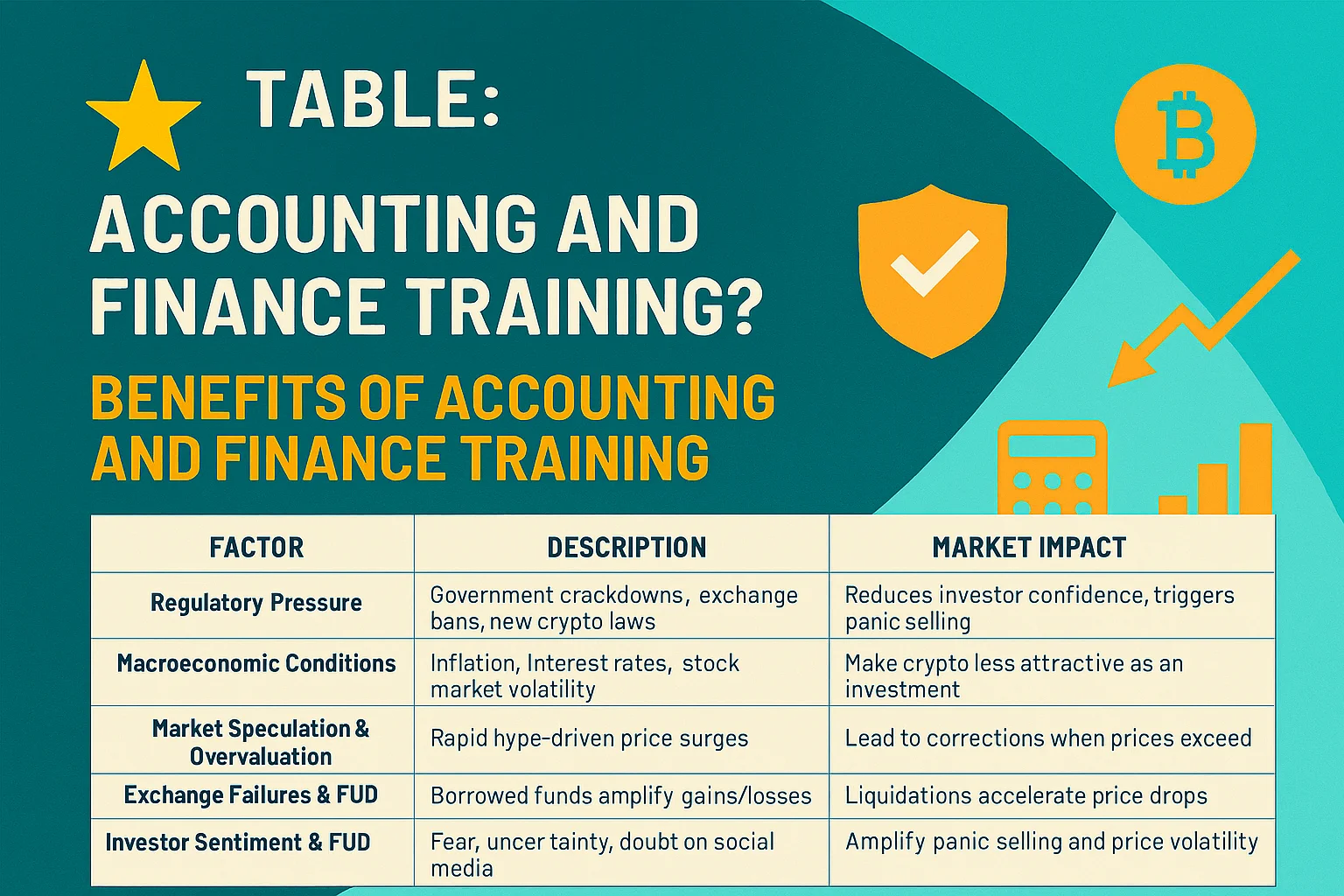

⭐ Table: Key Factors Behind Crypto Market Crashes

| Factor | Description | Market Impact |

|---|---|---|

| Regulatory Pressure | Government crackdowns, exchange bans, new crypto laws | Reduces investor confidence, triggers panic selling |

| Macroeconomic Conditions | Inflation, interest rates, stock market volatility | Makes crypto less attractive as an investment |

| Market Speculation & Overvaluation | Rapid hype-driven price surges | Leads to corrections when prices exceed intrinsic value |

| Leverage & Margin Trading | Borrowed funds amplify gains/losses | Liquidations accelerate price drops |

| Exchange Failures & Scandals | Hacks, bankruptcies, fraud | Erodes trust, prompts withdrawals and sell-offs |

| Investor Sentiment & FUD | Fear, uncertainty, doubt on social media | Amplifies panic selling and price volatility |

| Stablecoin & Algorithmic Failures | Peg failures or token collapses | Can destabilize DeFi platforms and markets |

| Correlation with Traditional Markets | Stock market declines or tech sell-offs | Crypto behaves like high-risk asset during downturns |

1. Regulatory Pressure

One of the most common triggers of crypto market crashes is regulatory uncertainty. When governments announce restrictions on exchanges, tax rules, or outright bans on cryptocurrencies, investors often panic. For example, announcements from China banning crypto trading or stricter regulations in the United States frequently result in significant sell-offs.

Regulatory pressure reduces market liquidity and erodes investor confidence, especially among retail traders who fear legal repercussions.

2. Macroeconomic Conditions

Global economic factors also impact the crypto market:

- Rising interest rates make traditional safe-haven assets more attractive than crypto.

- Inflation concerns can drive investors toward gold or stable currencies.

- Stock market downturns, particularly in tech-heavy indices, often correlate with crypto price drops.

Crypto is increasingly considered a high-risk speculative asset, so macroeconomic instability can trigger large-scale sell-offs.

3. Market Speculation and Overvaluation

Crypto markets are highly speculative by nature:

- Hype, media coverage, and social media promotion often drive prices above intrinsic or utility-based value.

- When investors realize prices are unsustainable, mass sell-offs occur.

- Historical trends show Bitcoin and altcoins experiencing 50–70% corrections after rapid price surges.

Speculation-driven volatility makes the market prone to sudden crashes.

4. Leverage and Margin Trading

A large portion of crypto trading involves leveraged positions:

- Traders borrow funds to amplify gains.

- When prices drop, forced liquidations occur automatically.

- This creates a cascade effect, accelerating market crashes and deepening losses.

High leverage can turn small price corrections into major market downturns.

5. Exchange Failures and Scandals

Trust is critical in crypto markets:

- Hacks, fraud, and bankruptcies often spark panic.

- Famous examples: FTX collapse and Terra/Luna failure.

- Loss of confidence leads to mass withdrawals and sharp price declines across the market.

6. Investor Sentiment and FUD

Fear, uncertainty, and doubt (FUD) spread quickly through social media, news outlets, and forums:

- Negative sentiment accelerates panic selling.

- Positive sentiment can temporarily stabilize prices, but widespread FUD often dominates during crashes.

Crypto markets are highly psychological, and emotions can drive rapid price movements.

7. Stablecoin and Algorithmic Failures

Some cryptocurrencies rely on algorithmic mechanisms to maintain value:

- Stablecoins losing their USD peg or algorithmic tokens collapsing can trigger market-wide panic.

- Such failures destabilize DeFi platforms, exchanges, and liquidity pools, magnifying crashes.

- Example: The Terra/Luna collapse caused billions in losses and created market panic.

8. Correlation With Traditional Markets

Although crypto was once thought to be uncorrelated with stocks, recent trends show strong market correlation:

- Sell-offs in Nasdaq, S&P 500, or tech stocks often coincide with declines in BTC, ETH, and altcoins.

- Investors treat crypto as a risky asset, so during economic uncertainty, demand drops, and prices fall.

Strategies for Investors During Crypto Market Crashes

- Diversify Portfolio – Spread investments across multiple assets to reduce risk.

- Use Stop-Loss Orders – Protect capital from major losses.

- Focus on Fundamentals – Invest in projects with real-world use cases.

- Avoid Panic Selling – Market corrections are normal; long-term investors can benefit.

- Stay Updated on Regulations – Knowing legal developments can help anticipate price swings.

Conclusion

Crypto market crashes are a natural part of the industry and usually stem from a combination of regulatory action, macroeconomic trends, speculation, leverage, exchange scandals, and investor sentiment. While crashes can be alarming, understanding these factors helps investors manage risk, make informed decisions, and even identify opportunities during market downturns.

By staying informed and disciplined, both beginners and experienced traders can navigate volatility and capitalize on the long-term potential of digital assets.