Personal finance training for beginners is becoming essential in today’s world — especially when prices are rising, job markets are shifting, and financial stress is increasing everywhere. Learning how to manage money is not complicated; it simply requires the right knowledge, consistent habits, and practical steps.

This guide will help you understand everything about budgeting, saving, investing, credit scores, debt control, and long-term wealth building. Whether you are a student, young professional, or someone starting late, this training will give you a complete roadmap.

Why Personal Finance Training Matters for Beginners

Most people struggle with money not because they don’t earn enough — but because they don’t know how to manage it. Personal finance training teaches beginners:

- How to control monthly expenses

- How to avoid unnecessary debt

- How to build savings consistently

- How to invest and grow wealth

- How to make informed financial decisions

- How to secure a financially stable future

With proper training, you gain confidence and remove financial anxiety from your life.

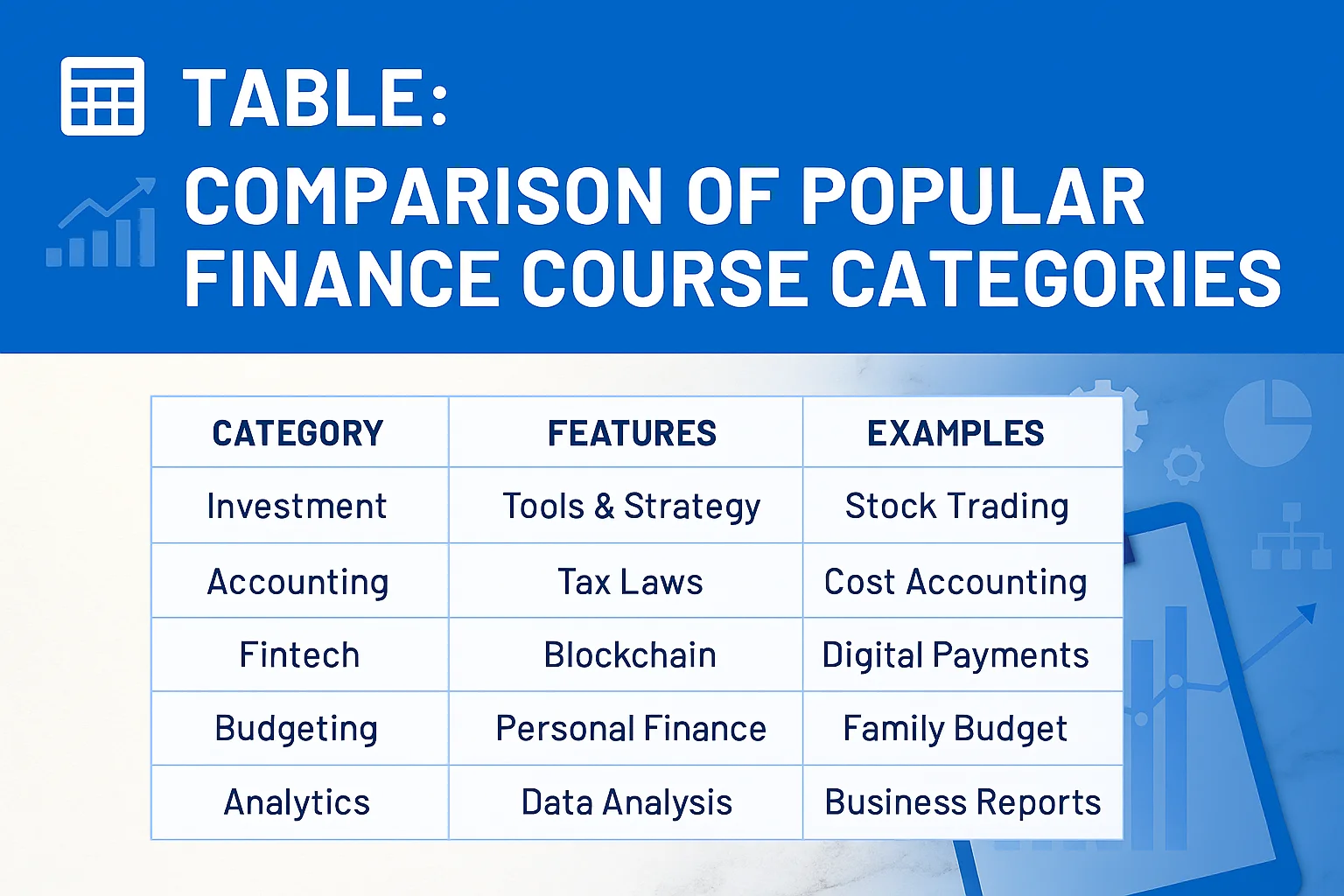

Table: Key Areas of Personal Finance Training for Beginners

Below is a simple table covering the most important areas:

| Training Area | What You Learn | Why It Matters |

|---|---|---|

| Budgeting | Planning income vs. expenses | Prevents overspending |

| Saving | Building an emergency fund | Protects you from financial crises |

| Debt Management | Handling loans, credit cards | Reduces interest burden |

| Investing | Stocks, ETFs, mutual funds | Grows long-term wealth |

| Credit Score | How credit works | Helps in loans & lower interest rates |

| Retirement Planning | 401(k), IRA, pension | Ensures future financial security |

| Risk Management | Insurance basics | Protects your assets |

| Goal Setting | Short & long-term financial goals | Gives financial direction |

This table covers the foundation that every beginner should understand.

1. Budgeting: The Starting Point of Personal Finance

Budgeting is the heart of financial training. It gives you control over your money instead of letting money control you.

Steps to create a beginner-friendly budget:

- List your total monthly income

- Break down your fixed expenses (rent, bills, transport)

- Identify unnecessary expenses

- Allocate a savings percentage

- Track your monthly progress

A realistic budget helps you build a strong financial base.

2. Saving: Your First Step Toward Financial Freedom

Savings protect you from unexpected expenses, job loss, medical emergencies, and future uncertainties.

Beginners should focus on three types of savings:

- Emergency Fund (3–6 months of expenses)

- Short-term savings (travel, gadgets, goals)

- Long-term savings (education, home, retirement)

Even saving small amounts consistently can transform your financial life.

3. Debt Management: Learn to Borrow Smart

Debt can be useful (like education loans) or harmful (high-interest credit cards). Beginners must learn:

- Difference between good debt and bad debt

- How interest rates work

- How to avoid minimum payments

- Debt repayment methods (snowball, avalanche strategies)

Controlling debt early stops future financial pressure.

4. Investing Basics for Beginners

Investing is not only for rich people — it’s for anyone who wants financial freedom. You don’t need large money to start investing.

Beginner-friendly investment options:

- Stocks

- ETFs

- Index funds

- Mutual funds

- Robo-advisors

Benefits of investing early:

- Higher returns over time

- Passive income

- Compound interest growth

- Financial security

Even investing $50–$100 per month can grow significantly over years.

5. Understanding Credit Score

Your credit score determines your financial reputation.

Why beginners must learn about credit score:

- Helps in getting loans

- Determines interest rates

- Affects renting a home

- Impacts insurance premiums

Maintaining a good credit score early makes your financial life easier.

6. Retirement Planning for Beginners

Even beginners should start thinking about retirement because early saving means less stress later.

Key retirement options:

- Employer retirement plans

- Pension schemes

- Individual retirement accounts (IRA)

- Long-term investment portfolios

The earlier you start, the more wealth you build through compounding.

7. Risk Management: Protecting Your Wealth

Insurance is a key part of personal finance training.

Types of insurance beginners should understand:

- Health insurance

- Life insurance

- Auto insurance

- Property insurance

Insurance protects your finances from major losses.

8. Setting Financial Goals

Without goals, money has no direction.

Set goals in three categories:

- Short-term (0–1 year) – new phone, emergency fund

- Medium-term (1–5 years) – education, car

- Long-term (5+ years) – home, retirement, investments

Goals help you stay focused and motivated.

Best Personal Finance Training Tips for Beginners

- Track every expense

- Avoid impulse buying

- Save before spending

- Use budgeting apps

- Learn basic investment principles

- Build an emergency fund

- Avoid high-interest debt

- Stay consistent

These small habits lead to big results.