In today’s fast-paced digital world, finance training courses online have become one of the most efficient and flexible ways to learn financial skills. Whether you want to manage your personal budget, enter professional finance, or advance your corporate career, online learning gives you access to high-quality, practical education from top instructors across the world.

With globally trusted platforms like Coursera, Udemy, and edX offering affordable, on-demand courses, 2025 is the perfect year to start building strong finance knowledge from home.

Why Finance Training Courses Online Are Growing Rapidly

Online finance education is becoming the first choice for students, professionals, and business owners. Here’s why:

1. Self-Paced Learning Flexibility

You can study anytime—during breaks, evenings, or weekends. No fixed schedules.

2. Affordable Compared to Traditional Education

You can access high-quality programs at a fraction of university costs.

3. Wide Range of Specializations

From personal finance to investment banking, everything is available.

4. Globally Recognized Certifications

Certificates add value to your resume and help in job applications.

5. Practical, Job-Oriented Training

Courses focus on real-world skills like modeling, trading, accounting, and analysis.

Types of Finance Training Courses Online

Below is a quick overview of the most popular categories:

1. Personal Finance Courses

Perfect for beginners who want to manage money wisely:

- Savings and budgeting

- Debt management

- Credit score improvement

- Retirement planning

- Investment basics

2. Corporate Finance & Financial Analysis

Best for those entering business or corporate roles:

- Financial modeling

- Budget forecasting

- Cash flow analysis

- Portfolio evaluation

- Company valuation techniques

3. Investment & Trading Courses

Ideal for market-focused learners:

- Stock trading

- Cryptocurrency trading

- Derivatives (options & futures)

- Technical analysis

- Risk management

4. Accounting & Bookkeeping

Essential for business owners and finance students:

- Accounting principles

- Financial statements

- Bookkeeping tools

- Business taxes

- Audit basics

5. Banking & FinTech Courses

Great for modern finance and digital banking enthusiasts:

- FinTech innovation

- Blockchain fundamentals

- Payment systems

- Anti-money laundering compliance

- Banking regulations

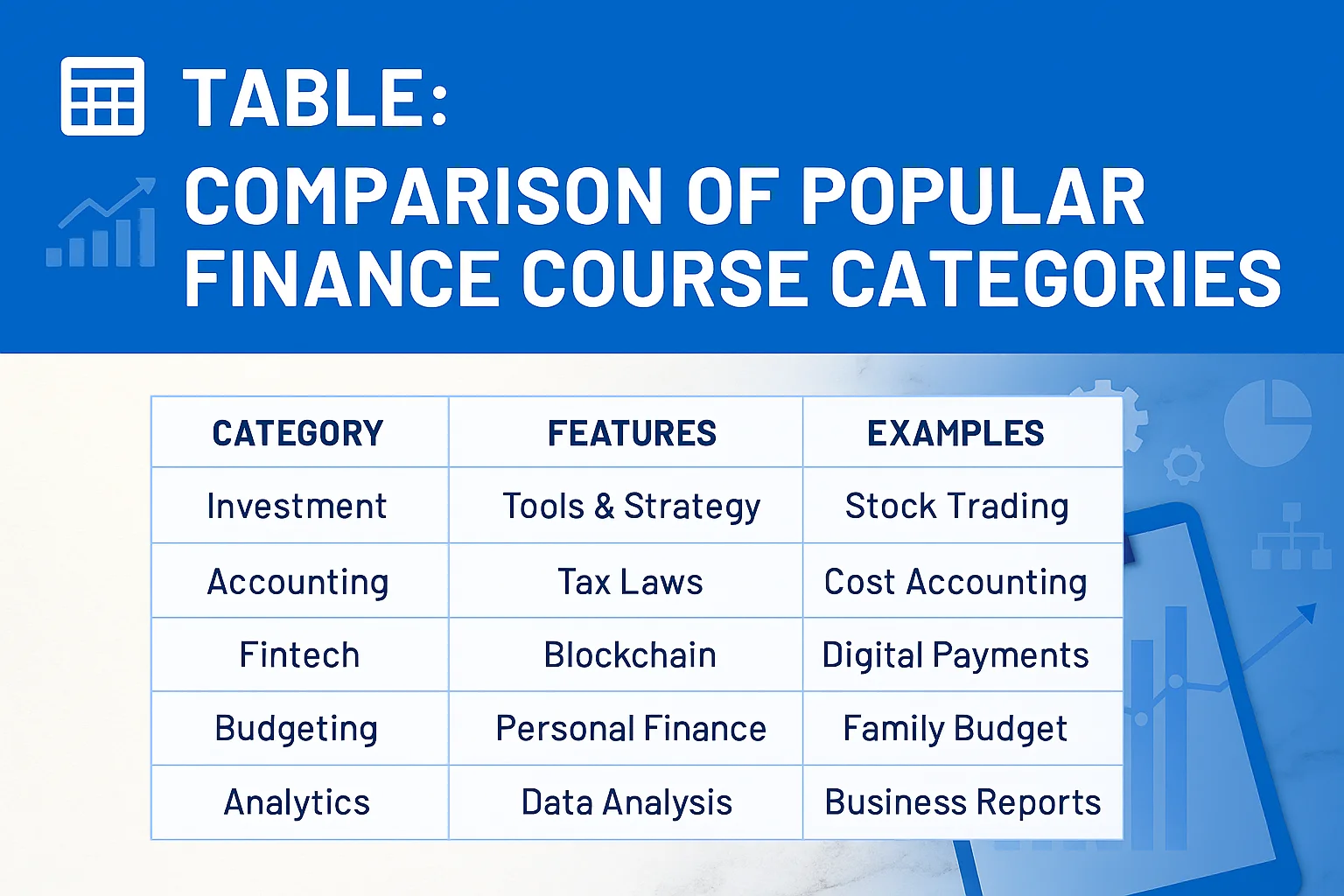

TABLE: Comparison of Popular Finance Course Categories

| Course Type | Best For | Skills You Learn | Difficulty Level |

|---|---|---|---|

| Personal Finance | Beginners, families | Budgeting, saving, investing | Easy |

| Financial Analysis | Students, professionals | Modeling, forecasting, valuation | Medium |

| Investment & Trading | Traders & investors | Technical analysis, trading strategies | Medium–High |

| Accounting & Bookkeeping | Business owners, accountants | Statements, bookkeeping, tax basics | Medium |

| FinTech & Banking | Tech + finance learners | Blockchain, digital payments, compliance | Medium–High |

Benefits of Finance Training Courses Online in 2025

✔ Build High-Demand Job Skills

Companies value candidates with strong analytical and financial planning skills.

✔ Improve Your Personal Money Decisions

Better budgeting, controlled spending, and long-term financial stability.

✔ Upgrade or Switch Careers

Online finance certifications help you enter roles like:

- Financial analyst

- Accountant

- Investment advisor

- Data-driven trader

- Business finance manager

✔ Learn Industry Tools

Courses often include training in:

- Excel modeling

- Financial software

- Trading platforms

- Data analysis tools

Who Should Take Online Finance Courses?

These programs are ideal for:

- Students entering business or finance

- Job seekers who want competitive skills

- Traders in crypto or stock markets

- Entrepreneurs managing their finances

- Employees looking for promotions

- Anyone aiming for financial independence

Top Platforms Offering Finance Courses in 2025

Here are reliable names trusted worldwide:

- Coursera

- Udemy

- edX

- LinkedIn Learning

These platforms offer beginner to advanced programs with certifications accepted by companies globally.

How to Select the Right Finance Course

1. Define Your Goal

Choose whether you want personal finance, corporate finance, accounting, or trading courses.

2. Check Instructor Background

Select courses taught by experienced professionals.

3. Look for Practical Assignments

Finance requires hands-on practice—case studies, models, real data.

4. Ensure Certification Availability

A certificate boosts your resume and credibility.

5. Read Reviews Before Enrolling

Ratings help you judge course quality and value.

Future of Online Finance Learning

Finance is evolving quickly with AI tools, digital banking, and blockchain.

Online courses adapt faster than universities, giving learners up-to-date industry knowledge.

By 2025, finance education will be even more personalized, offering:

- AI-powered learning paths

- Real trading simulations

- Virtual internships

- Industry-recognized micro-certifications

Conclusion: Start Your Finance Learning Journey Today

Whether you want to improve your financial life, boost your career, or dive into investing, finance training courses online offer the most flexible, affordable, and powerful path. With world-class platforms, expert instructors, and job-ready skills, you can start learning from anywhere and build a strong foundation for your future.